The Intelligent Automation Audit Platform for Mortgage Lenders and Servicers

Checkpoint Audit facilitates the job of the underwriter, the post-closer, and the loan auditor by enabling higher loan throughput, enhancing loan quality & accuracy, and reducing costs, while improving the borrower experience.

Classify mortgage loan documents in minutes.

Accurately extract data from the classified documents.

Run the customizable business rules, validating data in documents and the LOS.

Confirm the loan meets underwriting parameters with human-in-the-loop experts.

Supported Audit Functions

- Initial Underwrite: Audit the file for completeness before sending it to the Underwriter

- Appraisal Review: Automatically assess collateral risk within minutes

- Credit Review: Review and validate the credit report and identify discrepancies

- Income Review: Evaluate income documentation vs. calculations submitted to the AUS and Underwriting

- Asset Review: Automatically validate supporting asset documentation against the application and required assets for the loan product.

- Pre-Fund Audit: Run the audit to identify required documents and validate for missing or expired documents and data.

- CD Prep: Prior to generating the CD, validate collateral, insurance, and title data and documentation.

- Post-Close Audit: Run the data integrity audit after the file has closed but prior to investor delivery.

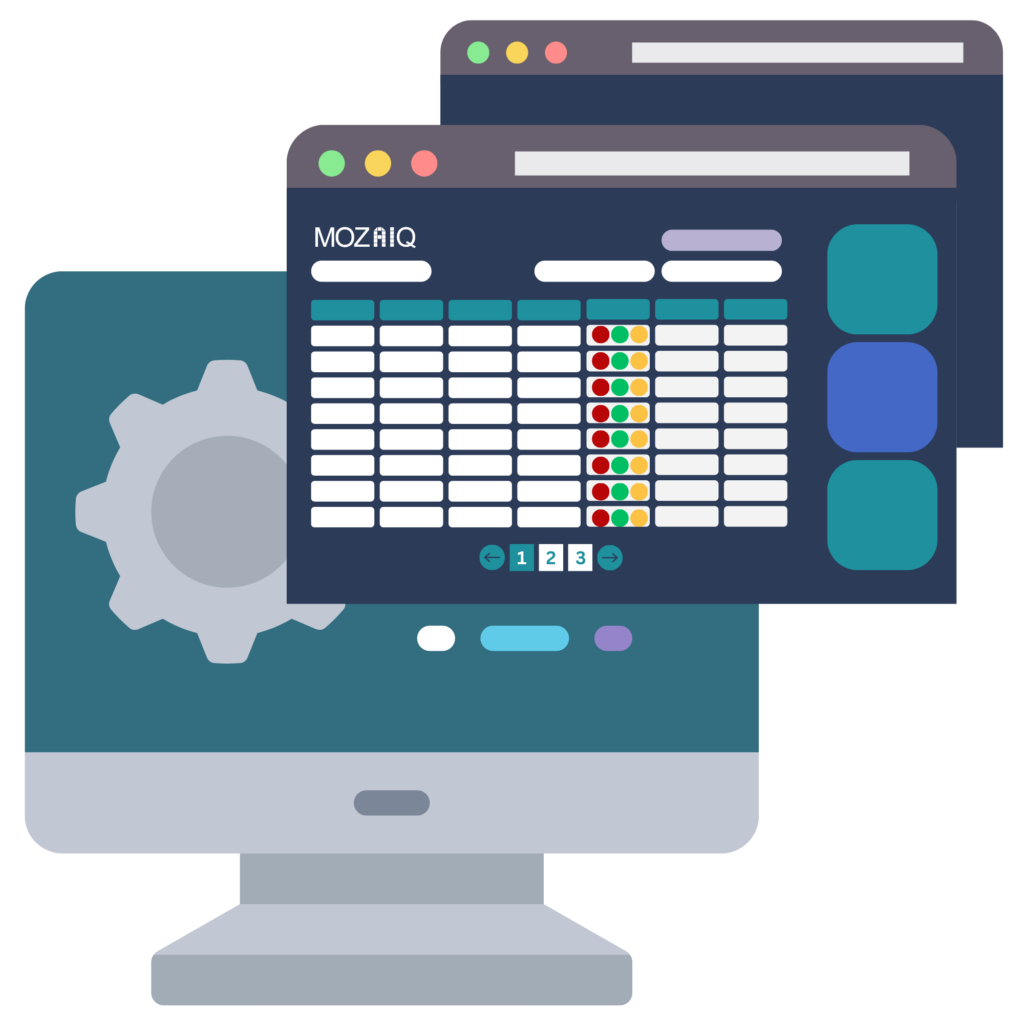

Documents and data are pulled from the system of record and validations are run automatically and consistently at the designated point in the loan process. Data and status can be pushed back to the LOS.

Checkpoint Audit can be customized and run at multiple loan stages for specific documents and rules e.g., for Initial Underwrite rules, CD and closing documents are not executed; for Post Close, the focus is on the final, signed closing documents.

Standard rules validate document availability, check expiration dates, and match extracted data values across documents, and the system of record. Business rules are configurable by client.

The rules engine can use calculations (such as income, DTI, TRID rules) to validate complex rules, including income, credit and appraisal analysis.

Humans-in-the-loop access the user-friendly interface to validate and audit business rules and extracted data values.