The Convergence of Mortgage and Artificial Intelligence

This article will highlight what the expectations are for the mortgage market in 2024, will identify the top trends in Artificial Intelligence (AI), including Gen-AI, and then will merge the two to show how AI can be leveraged in mortgage banking use cases.

What’s in Store for Mortgage in ’24?

Happy New Year! And let’s hope that it is indeed a Happy New Year in mortgage. Let’s get right to it. The Mortgage Bankers Association (MBA) predicts that the estimated total of mortgage originations in 2024 will surpass $2 Trillion, up 22% from the 2023’s total ($1.64 Trillion). Refinances are expected to be just 24% of the origination total, up from 19% in 2023, and, they expect that rates will end the year around 6.1%, with the Fed expected to cut interest rates three times in 2024 (Source: Housing Wire).

This makes 2024 a “recovery year”, as the mortgage market recovers and the brakes on originations start to loosen with: (1) lower rates; (2) a more fluid housing market; and if the latter happens, (3) home prices remaining steady.

Industry insiders tend to agree with this sentiment, although some are predicting that the mortgage rate needs to be closer to 5.5% to bring supply-demand parity into balance, given that the average mortgage rate for outstanding loans is around 3.7% (Source: Housing Wire).

What are the most talked about AI trends?

In reviewing some of the leading tech literature and blogs, several trends in AI are expected to become reality. How extensively these will be adopted remains to be seen, given that there are still doubts on how reliable Large Language Models (LLMs) are, given that the models make stuff up and are filled with biases. But, there seems to be hope that in controlled environments, generative-ai (Gen-AI) solutions will lead to tangible business benefits, whether it’s a reduction in costs, increased efficiencies, or a closer, more trusted relationship with customers and constituents.

Trend 1: Multi-Modal (Multi-Media) Models

Whereas the initial version of ChatGPT (3.5) and early implementations of ChatBots were primarily text-based, this year there is the expectation that LLMs will evolve into commercially viable solutions and will include text plus other assets like images, audio, and languages.

For example, an LLM could be trained with relevant documents and images that will allow appraisals to be more expeditiously and more accurately completed.

Trend 2: Small Language Models (SLM)

Instead of using LLMs as a base, customized Gen-AI models that are trained on a more limited dataset will start to appear for specific use cases. These tailored SLMs would be trained on high quality sources like textbooks, journals, financial reports, research reports, regulatory publications, and loan types. Companies would be able to tune these SLMs so that they can be tailored to specific tasks, with a narrow scope, so that accuracy increases and hallucinations decrease.

As an example, imagine a customized ChatBot that supports a Loan Officer (LO) so that the LO doesn’t have to reach out to an Account exec to answer every specific question regarding a product, or an LO who doesn’t have to compile pre-paperwork and then send that to the Account Exec just to see whether a borrower even falls within the qualifying parameters of a loan product. A BOT can also offer suggestion as to how to structure a loan that does fall into the qualifying parameters e.g., we saw that your borrower has another account that could counter the deficiency in another area etc.

If the ChatBot is trained on the specific loan types offered by the lender, and the regulatory and financial requirements, this SLM should be able to answer the basic preliminary questions, reducing cost, increasing performance, and enhancing the customer experience for all parties.

Trend 3: Augmented Knowledge Worker Adoption

Legal, financial services, marketing, artists and other creative workers will all benefit from leveraging Gen-AI to make their jobs easier. Why spend time summarizing a research paper when Gen-AI can do it for you? Why spend time on recreating a new contract? Why not let Gen-AI summarize the salient points from a meeting so that one can focus on higher-value tasks? Why not use AI to create marketing briefs, cover memos, and property summaries, while having human resources focus on managing the customer experience? And, why not augment coding skills and gain efficiencies in deploying software with Gen-AI?

Trend 4: Customized Chatbots

Google and OpenAI are creating web-based platforms that enable non-coders to customize large (and small) language models, creating “mini chatbots” that cater to a user’s specific (micro) need.

For example, why wait for your IT department when a non-technical user can create a miniChatBot for a narrow use case, like the example shared in an article in the most recent issue of the MIT Technology Review: “a real estate agent can upload text from previous listings, fine-tune a powerful model to generate similar text with just a click of a button, upload videos and photos of new listings, and simply ask the customized AI to generate a description of the property.” Even though they could simply cut and paste, the miniChatBot solution would more efficient.

Trend 5: Retrieval Augmented Generation (RAG)

Think of this as an LLM on steroids, with the drugs being external, specialized information, like new regulations published by Fannie or Freddie, or new loan products deployed in a mortgage lender’s portfolio, or appraisal information. This eliminates the need to store proprietary data and knowledge in the LLM (which most probably is owned and hosted by an external party like OpenAI, Google, or AWS), and increases the speed and lowers the costs of the transactions.

Top 5 Expectations at the Convergence of AI and Mortgage

And so, here are what we believe are the top five AI mortgage banking trends for 2024. One important item to note is that when we talk about AI or any type of intelligent automation solution, we are referring to automation as the configuration, integration, deployment and use of automation and AI technologies to streamline functions and scale processes in support of human workers.

What we see as trends in 2024

1) Gen-AI in Mortgage Will Go Mainstream

- Loan Officer and Broker support: essentially a customer service chatbot, allowing loan officers and brokers to query the bot for specific product information and pre-qualify a borrower for a particular product, prior to having to contact an account executive at the mortgage lender. The chatbot can also be pointed at a particular data source or document based on a user query to better respond to a question.

- Summarization and Synthesis: Summarize key insights from accounting pronouncements, appraisals, financial reports, financial news that impacts policies, processes, and reporting.

- Deep Retrieval: augment IDP solutions with Gen-AI to extract information from large amounts of unstructured data, without having to train the machine learning engine with hundreds of documents to achieve a high level of accuracy. For example, enable an underwriter to quickly find information from regulatory documents without having to search through thousands of pages.

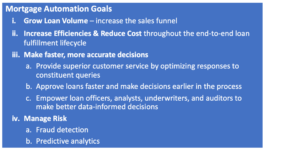

2) Automation Will Accelerate Margin Growth: Lenders that have invested in automation—RPA, IDP, ML, and even Gen-AI—will see their margins grow at a faster rate than traditional lenders, as they harness the power of technology to effortlessly scale while maintaining efficiencies.

3) AI and Human Workers will Co-Exist: Smart lenders will find ways to make automation and human experts co-exist – they have no choice in order to maximize technological efficiencies. For example, leveraging automation to support offshore workers that are performing “stare and compare” functions like pre-underwriting, appraisal review, and post-close checklists.

4) Hallucinations Will Persist if Gen-AI is Poorly Scoped: If Gen-AI or any automation solution is poorly implemented, there will be backlash and there will be regulatory intervention. For example, Gen-AI solutions in their current form, especially as they tend to “hallucinate” often, should never be used as recommendation engines, given the inherent bias in current LLMs.

5) Responsible AI Must be the Foundation for any AI (and especially Gen-AI) Solution: Successful implementors of Gen-AI will look at this strategically and how it can complement their already existing systems and human processors, meaning that for Gen-AI to work correctly, trust must be embedded into the system from day one, starting with a clear strategy and a design that embraces responsible AI and makes it a pillar of all automation initiatives.

The success of Gen-AI in any deployment rests on whether the models are reliable and work as per design. The present challenges of LLM hallucinations, bias, and in some cases toxic content, needs to be addressed before Gen-AI can safely proliferate to the masses. And until the US regulates AI, like the EU is doing, we’ll still get issues with deepfakes and false information, which is why responsible AI must be the bedrock of any AI initiative.

Note: this blog post was written by a real human and does not contain content generated by ChatGPT or any other Generative-AI platform.