World AI Cannes Festival – Intelligent Automation in Action

This is an edited summary of the talk I gave at the World AI Cannes Festival (WAICF) as part of the Applications Stage Program.

I was the last speaker on the first day of the conference, following Bjoern Rosenthal, Head of Product at DFL Digital Sports. For those of you that don’t follow European Football (soccer), DFL Digital Sports owns the rights to all Bundesliga and Bundesliga 2 content. The Bundesliga is the German Football League, one of the top five European Soccer Leagues. It was standing room only.

Mr. Rosenthal proceeded to showcase how they harnessed Generative AI to extract live match commentary and in near-real time, translate that to a running match commentary ticker, for every goal scored, shot on goal, foul, and other relevant events. The screen burst alive with players of the calibre of Harry Kane, Serge Gnabry, and Leroy Sané passing, crossing, and scoring. And the ticker worked. It was accurate, and timely.

Then it was my turn. From Football to Intelligent Mortgage Automation. Half the room emptied. But only half. And, as I told the remaining audience, the benefit of the last slot at a conference is that you’re that much closer to Happy Hour . . . But I digress.

The organizers had asked for a real-world example of intelligent automation in action, and I came prepared with a presentation on how the application of intelligent automation, artificial intelligence, and Gen-AI is helping a US mortgage lender survive the mortgage winter and how it is enabling it to be competitive as the market outlook improves.

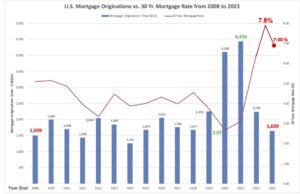

I started by setting the stage: what’s happened in the last decade, and in particular, the last four years, in the US Mortgage market? We know what happened, we survived it: the massive increase in mortgage originations due to the covid spike as people fled cities and the Fed kept rates low doubled origination volumes from 2019 to 2021, with over 60% refinancing to lower rates. Because of the speed of the growth, lenders didn’t have time to invest in technology to scale, so they did what they always do, hire more people, which increased their fixed cost base. As inflation rose, the Fed adjusted rates aggressively leading to a slowdown in originations, with rates peaking at 7.8% in October 2023, and origination volumes collapsing by 60% from 2021 to 2023. Ouch.

US Mortgage originations vs. 30 Yr. Mortgage Rates

Sources: Rates: Economic Research Division, Federal Reserve Bank of St. Louis; Originations: U.S. Mortgage Bankers Association (MBA)

So why automate mortgage if it’s in such poor shape? Simple. It’s exactly because of the cyclicality and because 500 page loan documents are still the norm, that it’s the most ideal to automate, the one with the most potential. The problem is that in the financial services stack, unlike investment banking, mortgage is the last segment to innovate and invest in technology. But there are smart lenders who scaled with technology and were able to absorb the slowdown. In order to understand how automation is a perfect match for mortgage, it’s important to level-set on the definition of intelligent automation first, then layer that on top of mortgage via a case study.

What is Intelligent Automation? MOZAIQ defines it as the configuration, integration, deployment and use of automation and AI technologies to streamline functions and scale processes in support of human workers.

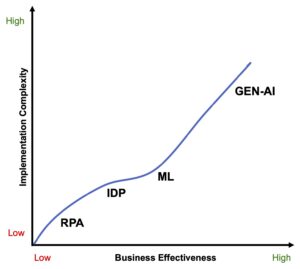

It’s not just one technology, it is a combination of solutions that supports human workers, and allows them to do their job better. In our world Intelligent automation is comprised of several components:

MOZAIQ’s POV on Intelligent Automation

- The most basic is Robotic Process Automation (RPA) – it’s been around since green screens, I was using it in 1989. It’s a commodity, after all.

- Intelligent Data Processing (IDP) – OCR technology configured for specialized uses, in this case data extraction from structured and unstructured content in documents.

- Machine Learning (ML) – leveraging AI to optimize the output from RPA and IDP processes, models are trained, but require a lot of data (hundreds of documents to train the model in the mortgage use case) and time e.g., pre and post processing of data.

- Generative AI (Gen-AI) – where it’s being deployed in a limited number of mortgage use cases, which is addressed in a separate post.

So let’s see intelligent automation in action for an Independent Mortgage Bank (IMB). The IMB, a national wholesale lender, was created with a philosophy comprised of two simple drivers: (1) be the low-cost lender and (2) deliver superior customer service. Because a mortgage loan is a commodity, if they stayed focused on these two drivers, they could sustain growth and profitability, and win. But how? They needed to ensure that their DNA supported these two goals as effortlessly as possible by leveraging outsourcing (domestic and offshore) to deal with the inherent fluctuation in loan processing volume and invest in technology and automation from day one.

An Automation Foundation to Build On

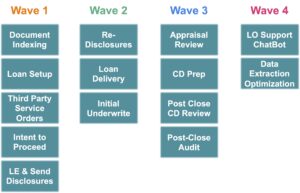

The IMB started with the basics, with the low-hanging fruit including document indexing, RPA automation, and data extraction from structured documents, functions that would allow them to measure the automation ROI in weeks (and not months) and build a platform to grow their automation initiatives (avoiding the pitfall of creating point solutions, i.e., deploying technology for technology’s sake).

They progressed to more complex processes, and in particular supporting the “stare and compare” processes for auditors and underwriters, combining document indexing, data extraction, and machine learning (pre- and post-processing) to further optimize the data—Initial Underwrite, Appraisal Review, CD Prep, and Post-Close Audit.

Automation Helps To Seamlessly Absorb Volume Fluctuations

The automation foundation was important in allowing the IMB to absorb the wholesale origination portfolio of a top ten wholesale lender that had to disband, an acquisition that was completed in the first quarter of 2023. Because the IMB’s strategy was predicated on scaling with technology (and automation) first, they were able to absorb a three-fold increase in loan volume in a 3 month period—see the adjacent chart tracking loan volume for two sample processes: Loan Estimate and Loan Delivery.

They did this by spinning up more VMs, spinning up more BOTS, and leveraging the automation framework fabric to scale, minimizing the number of operations and tech resources that they brought over from the acquired lender. And, with the ops and tech personnel savings, they then invested in sales and marketing (account management) personnel, continuing to scale the wholesale channel by acquiring broker relationships at a reduced fixed cost, knowing that they could scale the volume with automation.

The benefits achieved by the IMB were astounding:

- Higher loan quality and loan accuracy near 99%, with the combination of intelligent automation and offshore expert resources, helping to satisfy the new GSE audit requirements and eliminate potential fiscal and reputational penalties.

- Reduced cost per loans of up to 60% the savings going straight to improving profitability.

- The next three benefits go hand in hand: Underwriters are able to process more loans per hour thanks to automation. Remember what we said earlier, that intelligent automation is deployed in support of human workers? This is exactly that in action – whether it’s an appraisal review or a credit decision or a post-close audit process, expert resources can now do more with less, focusing on resolving exceptions and errors instead of chasing paperwork. And, by allowing the automation to run 24 x 7, the loan pipeline is prepped when the underwriters start the work – no more waiting around.

- Faster loan throughput times by up to 3x, allowing the same number of processors to do more with less.

- 24×7 Loan processing at any time of day, or night, further increasing loan throughput and enhancing customer service.

- 70% reduction in loan underwriting time thanks to the higher accuracy and faster throughput.

- Outcome-based transaction pricing: because our solution is offered as a service, the IMB only pays for what they use, with minimal configuration fees, shifting loan processing costs from fixed to variable, enhancing their bottom line.

And finally, an additional critical benefit is that the IMB can scale up with intelligent automation by provisioning technology resources, as the loan volumes increase, without incurring unnecessary fixed costs, and is now optimally positioned to take advantage of the expected 20% growth in the 2024 mortgage origination market (based on the latest MBA estimates for 2024).

My full talk at Cannes, which will be available online by mid-March 2024, included topics such as Gen-AI and Best Practices for implementing intelligent automation. Look for these topics in upcoming blog posts. Stay tuned!

Note: This blog post was written by a real human and does not contain content generated by ChatGPT or any other Generative-AI platform.