Once upon a time…

When I graduated from college, in 1989, my first job was with a startup called Cambridge Technology Group (CTG), the forerunner to Cambridge Technology Partners, a systems integration pioneer of the early nineties. CTG was in the business of executive education, training entire sales forces for the likes of AT&T and NCR on how to sell an emerging computing platform called UNIX. To showcase the flexibility of the operating system vis a vis Mainframes, we developed scripting tools that “scraped” data off of mainframe screens, took that data and input it into a different screen, sometimes directly to a different mainframe, and automatically executed commands. We even built an early GUI platform to create customized displays of the data – the data that was scraped from multiple modules across multiple mainframes automagically appearing on one single screen at the touch of a button. The audiences were shocked, stunned. They had never seen anything like it.

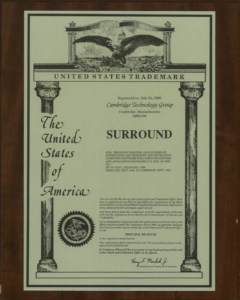

We called it the “SurroundTM” Architecture (yes it was trademarked). The scripting tools morphed into platforms – TalkAsync for screen scraping (TalkSNA for IBM), DataHandler for storing and mapping the fields (dh_get, dh_put), User Interface (not very original) for displaying the data. Shell scripts filled the gaps. In 1989.

Back to Reality

Fast forward thirty-two years. How has the technology evolved? Now data can be extracted from scanned documents (and from screens and via web automation and through API calls). Now we have Python to fill the gaps. Now we can program scripts to perform complex human functions. There are entire toolkits and frameworks and platforms that enable a non-coding user to program these scripts. Except now they’re called BOTs. And now the Surround Architecture is called RPA. So what?

The point is, the concepts are old, and the Robotic Process Automation (RPA) market is commoditizing – there is little differentiation across offerings. Sure, one orchestration platform functions more efficiently than the other, one drag and drop user interface is easier to use. Yes, today’s computing power enables the deployment of Machine Learning so that you can “train” your solution to be smarter, faster, more accurate.

But if you’re a company selling an RPA platform, you’re running out of runway. You sell product based on features. You’re stuck in the nuts and bolts. Your product does what your competition does, in some cases better, in others worse. You’re not talking about what it can do for your customer. How your customer benefits. What new capabilities your customers can unleash. You can’t, because all RPA platforms do the same thing. And, your customer is tired of forking thousands of dollars, in some cases hundreds of thousands of dollars, up front, for a piece of software that may or may not get deployed into production. And that is not all the spending that the customer will have to do to operationalize the platform.

Enter MOZAIQ

That’s our take on it. On this market. So when we decided to create a Mortgage automation solution to address Wave 3 (see the prior blog post), we knew that RPA alone wasn’t going to cut it. BOT’s by themselves are limited.

An effective Intelligent Automation solution requires that multiple components work seamlessly together. A BOT needs to be trained. A BOT needs to be managed. The documents need to be classified (indexed), and data needs to be extracted AND cleansed (no existing OCR solution extracts data with 100% accuracy) before the BOTs can go to work. Loan origination systems need to be integrated with. Audit trails are mandated.

The MOZAIQ platform has integrated these disparate requirements into one simple, easy to configure and deploy platform. Our SaaS offering, targeted at the Mortgage ecosystem, is a digital worker-enabled per loan transaction model, eliminating costly software licensing and startup costs, allowing customers to keep costs in line with loan volume. Its pre-built offerings deliver foundational and vertical process automation out of the box, while allowing customizable processes and services to be built on top of the core intelligent platform.

MOZAIQ is in the Intelligent Mortgage Automation business. We don’t sell software, we sell a solution that enables our customers to achieve rapid benefits, whether it’s reducing processing costs, increasing loan processing throughput, increasing accuracy past 99% and enabling scale – up or down – through the deployment of pre-trained digital workers.

Find out more at www.mozaiq.ai and check out the process demos at www.mozaiq.ai/demos.