Intelligent Mortgage Automation. Delivered.

Improve loan quality, accelerate loan processing times and reduce origination costs with our market-leading, AI-powered mortgage automation offerings

MOZAIQ is the Intelligent Mortgage Automation Leader.

We’ve harnessed artificial intelligence to create the leading AI-powered mortgage origination back-office solution that helps lenders increase their loan quality, improve processing efficiency, and cut costs.

Our solution automates multiple mortgage back office processes across the entire mortgage loan fulfillment lifecycle.

PROCESSING

Accelerate loan setup times and get the file to the underwriter faster.

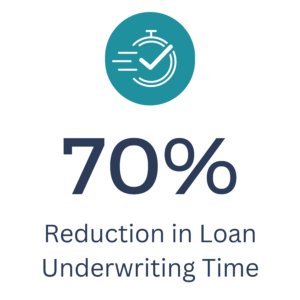

UNDERWRITING

Make faster, more accurate lending decisions.

CLOSING AND FUNDING

Rapidly finalize the mortgage loan prior to closing and funding.

POST-CLOSING AND SHIPPING

Send the fully audited loan to investors with confidence.

Join the Mortgage Automation Revolution.

Don’t get left behind. Partner with the Intelligent Mortgage Automation leader. Join the Mortgage Automation Revolution, and get ready for the inevitable growth that’s coming in refi’s and new originations.

Intelligent Automation Insights

How Intelligent Automation Helps Mortgage Lenders Scale

This is an edited summary of the talk I gave at the World AI Cannes Festival (WAICF) as part of the Applications Stage Program.

Should We Slow Down AI Research?

Are we moving too fast with AI R&D?

What to Look for in 2024

Mortgage and Intelligent Automation will converge in 2024

2023 Going into 2024

We wanted to reflect on our accomplishments and see what’s in store for 2024