Should I Automate

Automation is no longer an “if” but a “when” in the Mortgage industry, as mortgage lenders rush to automate their processes in search of greater efficiencies as rising interest rates and the drop in loan volume compress their already thin margins. The challenge is that they lack the know-how to effectively develop an automation solution. This post illustrates how mortgage lenders can easily automate their mortgage processes without having to invest in expensive software licenses and without requiring in-depth technology and automation skills in-house.

MOZAIQ is a leading fintech company that delivers Intelligent Mortgage Automation solutions and pairs decades of Mortgage domain knowledge with expertise in the premier automation products in market, such as Automation Anywhere, UiPath, Google AI, and Microsoft AI. We offer a suite of pre-built automation solutions together with an opinionated deployment roadmap based on years of experience in deploying technology solutions in the Mortgage industry. Our solutions are rapidly configured and deployed enabling clients to achieve a faster ROI with savings of up to 60%, allowing them to deploy skilled resources to high value tasks, achieve greater loan throughput i.e., a higher number of loans can be processed in the same amount of time, with higher accuracy. MOZAIQ’s solutions are offered on per loan basis, meaning that customers don’t have to spend inordinate amounts of money just to setup the solution, they only pay for what they use.

Here are two examples of MOZAIQ’s pre-built Mortgage automation solutions. The time to go live with these solutions is less than 4 weeks, and customers don’t pay until loans are processed.

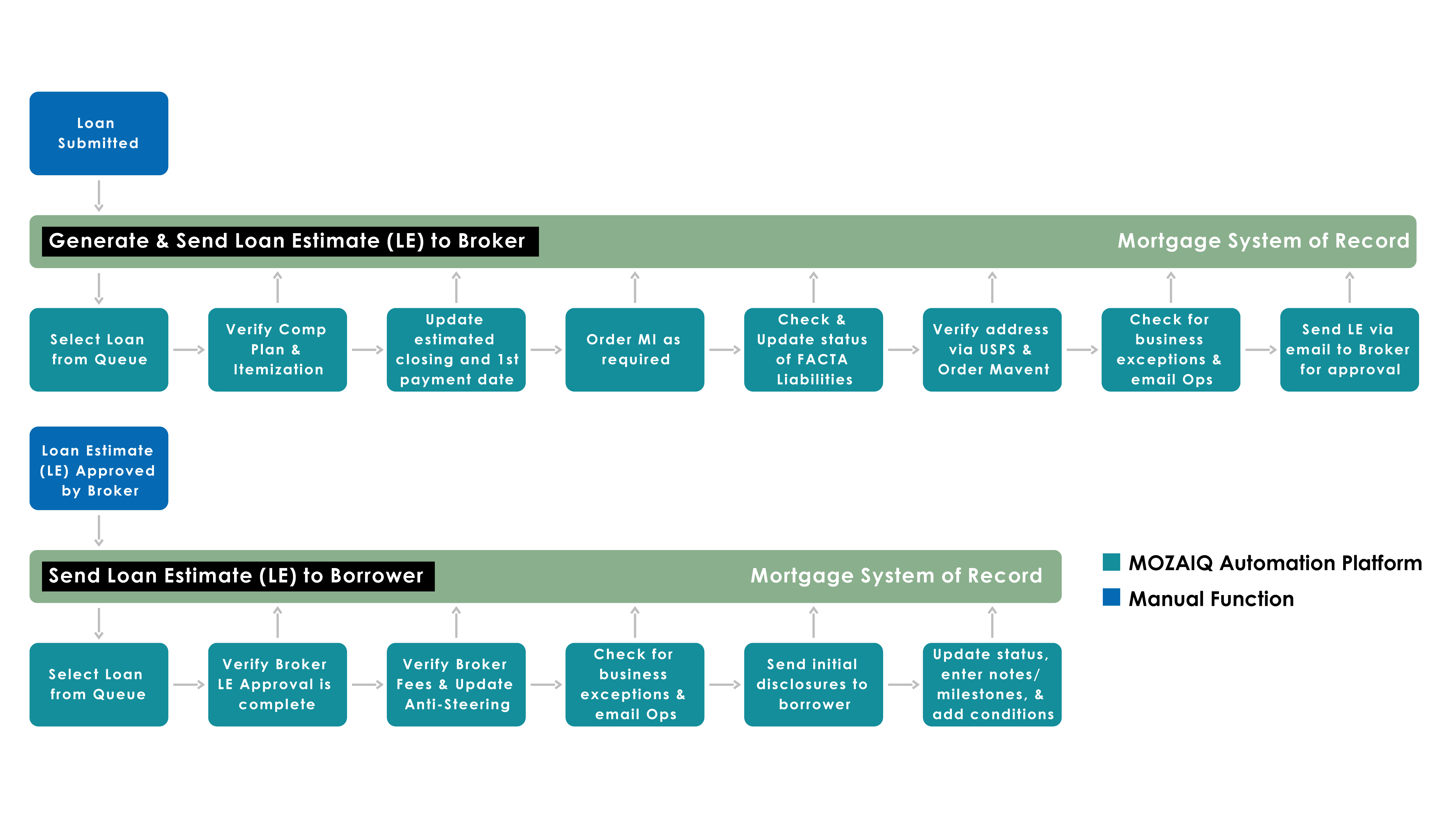

Review Loan Estimate (LE) & Send Disclosures

The Digital Worker verifies the loan fees, broker pricing and runs a report prior to generating the Loan Estimate (LE). The digital worker then sends the LE to the broker for approval, monitors email responses from the broker, and once the approval is received, it updates the Loan Origination System (LOS). It then sends the initial disclosures to the borrower, adds the default underwriting conditions, updates the milestone and notifies the Mortgage operations team to execute the next steps in the loan process.

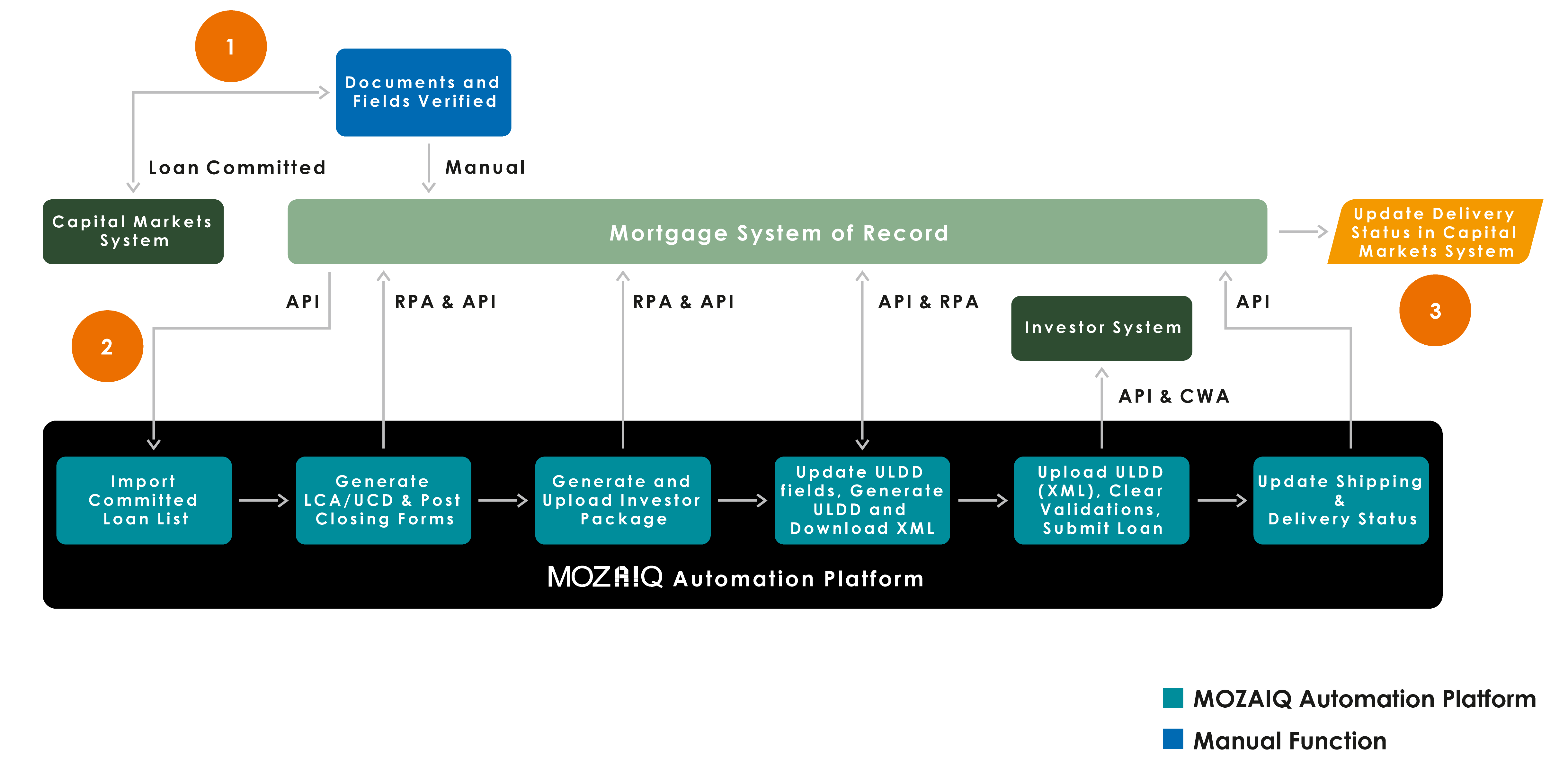

Loan Delivery

The Loan Delivery digital worker (BOT) is trained to interact with multiple third-party websites. It generates LCA (Loan Collateral Advisor) & UCD (Uniform Closing Dataset) reports, verifies UCD status, and generates relevant post-closing forms. It exports the ULDD (Uniform Loan Delivery Dataset) xml files to Fannie, Freddie and other investors loan delivery websites, resolves critical errors and uploads the shipping package. It then creates settlement forms and updates the loan delivery status in the LOS.

- The loan is committed to an investor. Once the ops user has validated the documents, signature and fields, she kicks off the process in the Loan Origination System (LOS)

- The MOZAIQ platform monitors a queue in the LOS and when one or more loans are committed, imports the loan list and initiates the process – every step is then automated

- The MOZAIQ platform signals to the LOS that the loan delivery process is complete, and the LOS updates the status in the Capital Market System

By deploying Mozaiq’s intelligent mortgage automation solution, mortgage lenders can achieve faster ROI and reach their automation goals more quickly, hedging against the origination slowdown and preparing them to scale with digital workers at a lower cost when the origination tide will turn.

MOZAIQ’s AI platform delivers out of the box and customizable process orchestration, automation frameworks and intelligent data processing capabilities – ready-made to enable intelligent automation for the Mortgage industry.

Find out more at www.mozaiq.ai and check out the process demos at www.mozaiq.ai/demos/.