Automation and the Mortgage Origination Slowdown

There’s no more doubt: the Mortgage market is in a slump. You read about it, hear it, every day, in the papers, online, on social media. Rising Interest rates (30-year fixed north of 6.5%), persistently high inflation (8.6% as of May 2022), the Fed curbing its bond-buying program, uncertainty in Ukraine and its impact on the global supply chain – all of these are directly and indirectly contributing to the mortgage market slowdown.

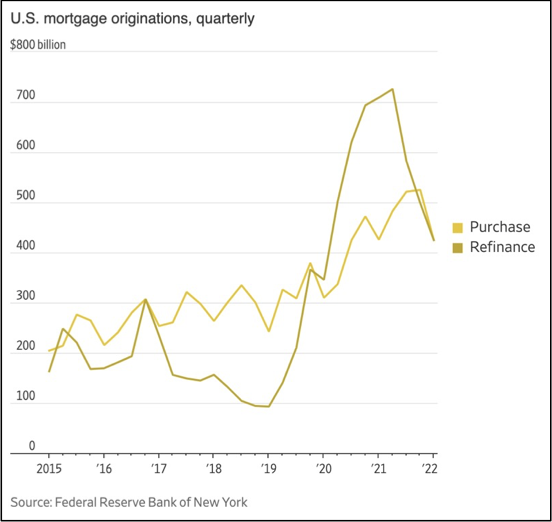

After several years of record origination volumes ($4 Trillion in 2021), the next 3 years’ origination volumes are expected to average approximately $2.5Trillion (a drop of 37% for 2022 alone). Still seems big, right? But, although house purchases will continue at near the current rates, refinancings will drop to all-time lows: the Mortgage Bankers Association (MBA) has predicted that purchase volume will grow by no more than 4% in 2022 and remain relatively flat in 2023. Refinance volumes on the other hand have taken a significant hit (50%) in 2022 and are predicted to further fall by 20% in 2023, before rebounding in 2024.

| 2021 | EST – 2022 | EST – 2023 | EST – 2024 | |

| Total Origination Volume | $4Trillion | $2.5Trillion | $2.4Trillion | $2.6 Trillion |

| Purchase Volume | $2.3 Trillion | $1.72 Trillion | $1.77 Trillion | $1.84 Trillion |

| Purchase Volume % | 57.5% | 68.8% | 73.8% | 70.8% |

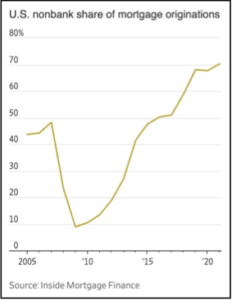

This translates to severe challenges for Mortgage Lenders. Non-bank lenders are being hit hard, as they do not have multiple lines of business to support them during a mortgage downturn, as such they are laying off staff, selling servicing rights, even considering selling themselves.

And although home prices continue to rise and Americans are still buying houses, the drop-off in refinancing activity is a giant blow because refinancing made up the bulk of U.S. mortgage originations throughout the pandemic (Rocket Mortgage reported that nearly 80% of their originations in 2021 were refinances).

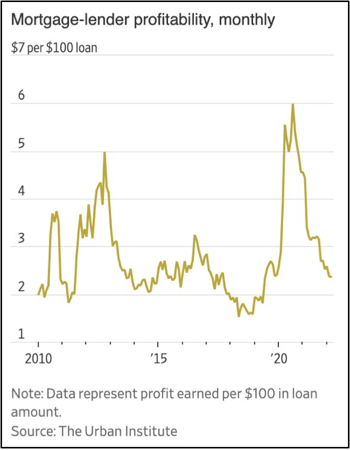

Margin compression has been a major shock; in March 2022, mortgage lenders made $2.36 in profit on every $100 of a loan, the smallest amount since 2019, according to the Urban Institute. In 2020, that figure was as high as $5.99. Taking a $300,000 loan as an example, the margin differences are staggering: from $17,970 down to $7,080 per loan, a drop of over 60%.

As if this wasn’t enough bad news, Jamie Dimon says “I said there were storm clouds, big storm clouds. Now it’s a hurricane. We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself…”

All is not lost: how to weather the storm and position to win once the clouds pass.

So, is it time to throw in the towel? If lenders are prepared to weather the storm, it’s not necessary. Even though the low point of origination volumes for the next few years is unknown, the high levels of the last few years should have allowed the smarter lenders to generate cash at levels that should see them through this trough, while making the appropriate adjustments. Many of these same lenders are embracing this slowdown as an opportunity – an opportunity to get operationally efficient by investing in technology platforms that positions them to better withstand the cyclicality of the mortgage market, allowing them to take advantage of future growth while hedging against downturns – think about it – the current interest rate environment is creating a future customer base that will refinance once rates stabilize and begin their inevitable downward descent (and I’m one of them). How to prepare for this explosive growth?

There are different areas of technology that lenders can invest in or enhance. Traditionally, lenders have been focused on the customer experience, and rightly so, moving portions of the client interaction and processing online – think Better.com, Ally Bank and SoFi. Many lenders have invested to catch up to these market leaders. But this has created a problem – the focus on the customer online experience came to the detriment of back-office processes, where the loan margins are impacted the most. Think Loan Setup, Lock Confirmations, Pre-Underwriting, Post Closing, Loan Delivery – all highly manual intensive processes because many lenders still use loan origination and peripheral systems from the nineties, and the sheer volume of loans in the last two years has left them fat and happy. Why invest in technology when I need all hands-on deck to process as many loans as I can as fast as I can? Now that the loans have dried up, lenders are left with bloated back offices that require trimming, shedding and as discussed above, potentially a sale.

Let’s go back to the lenders that are embracing this as an opportunity. They are investing in back-office technologies predicated on a cloud and digital first strategy, implementing API Based solutions to enable interoperability and configurability, and deploying automation. This latter focus, with advances in artificial intelligence (AI) and machine learning (ML) technologies, the opportunity to accelerate the “loan origination to close” processes while containing costs and driving efficiencies has arrived. But it’s not enough to simply invest in a generic automation solution – it’s important to ensure that Mortgage domain knowledge is embedded into the automation solution so that the platform can be stood up faster and can accelerate the ROI for the Mortage lender (see our in-depth post on this topic).

What questions should Mortgage Lenders ask when embarking on their automation journey?

- Where are my most inefficient processes – the ones that impact margins the most – loan estimates, lock confirmation, pre-underwriting, post-closing to name a few

- Do I have IT development and deployment skills in house – do I have enough knowledge and talent to implement this myself, or do I need an external expert

- What’s my budget – do I have enough “dry powder” from the growth phase to invest in deploying an automation solution?

- What’s my business case? When will I achieve an ROI, what are my success metrics, is it cost savings or efficiency gains or both that I am targeting?

- Can I manage the platform in-house – or do I need an external expert?

- Do I need to reconfigure my current processes – will I be throwing good money after bad if I neglect to iterate the design of the automation solution with my processes?

How can MOZAIQ help Mortgage Lenders?

MOZAIQ is the first to harness the power of AI and ML to build a domain-centric platform – the first Mortgage-focused automation platform – that allows Mortgage lenders and servicers to rapidly deploy automation solutions, enable operational flexibility and achieve a faster ROI.

The MOZAIQ SaaS offering is a digital worker-enabled per loan transaction model, eliminating costly software licensing and startup costs, allowing customers to keep costs in line with loan volume. Its pre-built offerings deliver foundational and vertical process automation out of the box, while allowing customizable processes and services to be built on top of the core intelligent platform and deployed either on-prem or in the cloud. MOZAIQ has pre-built automations in five areas of origination:

- Loan Setup

- Underwriting

- Closing and Funding

- Post-Closing and Shipping

- Servicing

What’s more, you don’t have to automate the entire origination lifecycle, even implementing two or three pre-built automation processes can bring efficiencies – with zero up-front capital costs, clients benefit from a per-transaction pricing model. Our customers have achieved cost savings of up to 60%, increased their loan throughput by up to 300%, reduced cycle times and eliminated costly manual errors.

MOZAIQ allows you to deploy these automations without any capital outlay from a Mortgage bank. You simply pay for what you use AFTER it is deployed. In other words, our business model is outcome based, so if you succeed, then MOZAIQ succeeds.

What benefits can Mortgage Lenders expect to gain by partnering with MOZAIQ?

- Pay only for what you use: With zero licensing costs, MOZAIQ’s automation platform is delivered using software as a service, allowing buyers to only pay for what they use on a per transaction (i.e., per loan) basis.

- Rapid deployment: Go live into production in less than four weeks, instead of waiting three to six months for just a proof of concept.

- Cost Savings & Rapid ROI: With no up-front implementation or deployment costs combined with rapid platform deployment, decrease loan processing costs by up to 60% and reach your ROI faster.

- Scale on-demand: Our solution enables frictionless scale to support volume fluctuations, whether volumes go up or down.

- Faster turn-around times: Process, fund and close loans up to three times faster.

- Greater productivity: Improve governance and compliance with robust audit trails and traceability.

- Higher accuracy: Reduce errors with digital workers and achieve accuracy levels greater than 99%.

- Out of the box integration: Plug and play with a majority of Mortgage Loan Origination Systems and other systems of record.

Summary

The mortgage market is cyclical. Mortgage lenders that deploy automation solutions NOW will reap the benefits when the next refi cycle returns, hedging against future downturns.

MOZAIQ is in the Intelligent Mortgage Automation business. We don’t sell software, we sell a solution that enables our customers to achieve rapid benefits, whether it’s reducing processing costs, increasing loan processing throughput, increasing accuracy past 99% and enabling scale – up or down – through the deployment of pre-trained digital workers.

Find out more by Contacting Us or checking out the process Demos.

Sources: The Wall Street Journal, Mortgage Bankers Association, Urban Institute, Inside Mortgage Finance, Yahoo! Finance