What is Intelligent Automation?

Last week MOZAIQ had the pleasure of jointly hosting a webinar with our partner Gooi Mortgage. The webinar topic was Intelligent Automation plus Expert Underwriting Resources. We showcased how intelligent automation turbocharges efficiencies and allows expert underwriting resources to be even more productive, processing twice the number of loans in the same amount of time, without sacrificing quality and accuracy.

In this blog post I want to highlight one of the key themes of the webinar: what, exactly, is intelligent automation? MOZAIQ wants to set the record straight, as various definitions abound in the ether.

Intelligent automation is the configuration, integration, deployment and use of automation and AI technologies to streamline functions and scale processes in support of human workers.

We look at intelligent automation as an ecosystem, powered by multiple technologies, that supports expert resources. It doesn’t mean that one can’t deploy a single automation solution to solve a business problem. What’s important is to understand that each automation solution has its own challenges when it must scale across multiple, and complex, use cases. Here’s why.

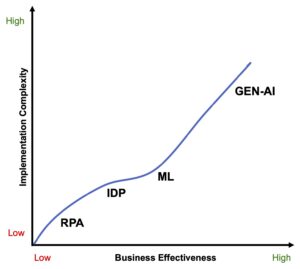

Of these automation solutions, the most basic is Robotic Process Automation (RPA) – it’s been around since green screens. I was using it in 1989. It’s a commodity, now. And it’s unstable, expensive (have you checked the licensing agreements from the major RPA vendors lately?), and has a low return on investment (ROI).

Then there is intelligent document processing (IDP). It’s OCR technology configured for specialized uses, in mortgage lending it is typically configured to extract data from structured and unstructured content in documents. The problem with IDP is that the accuracy is finite.

This is where Machine Learning (ML) comes in: Artificial Intelligence (AI) is leveraged to optimize the output from RPA and IDP processes. ML models must be trained, and require hundreds of documents, reams of data, and time; and one will still rarely achieve above 85% accuracy levels, and then only if pre- and post-processing is applied to the documents and extracted data, respectively.

Finally, there’s Generative AI (Gen-AI), an emerging technology that’s prone to hallucinations, which should be avoided when processing a mortgage loan and making lending decisions. It is, however, being deployed in a limited number of mortgage use cases, for example, enhancing data extraction from documents that have high variability or where there just aren’t enough documents available to properly train the ML model.

The following chart illustrates the business effectiveness vs. complexity and cost of implementation for each solution.

MOZAIQ’s POV on Intelligent Automation

What MOZAIQ believes is that true intelligent automation comes from combining all of these technologies and deploying them to solve for targeted use cases in support of expert human resources. In other words, solve for a legitimate business problem, and enhance the effectiveness of a lender’s most expensive resources.

As an example, MOZAIQ Checkpoint Automation Platform delivers intelligent automation services across the end-to-end mortgage fulfillment lifecycle. These services include Initial Underwrite, Pre-Underwriting Audit, Appraisal Review, and Post-Close Audit to name a few. Because the fundamental framework and building blocks are present in the platform, and because Checkpoint enables best-of-breed automation components—RPA, IDP, ML, Gen-AI—to be “plugged” into the platform, our customers don’t have to worry about software licensing, configuration, installation, running or monitoring the platform. MOZAIQ does it all for them by providing Mortgage Automation as a Service.

Contact MOZAIQ to find out how intelligent mortgage automation can save lenders time (by increasing processing efficiencies by 50%), and money (reducing loan origination costs by up to 50%), making the lender’s expert resources even more productive.

Note: This blog post was written by a real human and does not contain content generated by ChatGPT or any other Generative-AI platform.