Intelligent Mortgage Automation: A Primer

In this blog post, we’ll highlight the technology building blocks that enable intelligent mortgage automation, how best to deploy these platforms, and the benefits they deliver to mortgage lenders.

What is Intelligent Automation

Intelligent Automation (IA) is the configuration, integration, deployment and use of automation technologies—Artificial Intelligence (AI), Intelligent Data Processing (IDP), and Robotic Process Automation (RPA)—to streamline functions and scale processes across organizations. These technologies don’t just function automatically, they also “think” and learn and improve without human intervention.

What Technologies enable Intelligent Automation

The most critical component of IA is artificial intelligence (AI). AI uses machine learning (ML) to analyze structured and unstructured data and to continually improve its ability to create predictions based on the data. AI is also used to guide the RPA BOTS (see below) and to continually make them smarter, so they can think and get things done more quickly and efficiently.

Intelligent Data Processing (IDP) is a software platform that once trained extracts structured, semi-structured and unstructured data from documents. It uses AI technologies such as natural language processing (NLP), Computer Vision (OCR), and machine learning (ML) to classify (or index the documents), extract relevant data from the documents, and validate the extracted data.

Robotic Process Automation (RPA) is a software platform that enables the creation, deployment and orchestration of BOTS that emulate human actions interacting with digital systems and programs. An RPA platform consists of multiple BOTs and manages, coordinates and synchronizes the tasks of the BOTs much like a human manager or supervisor would. Note that one doesn’t have to use an RPA platform, as its accuracy and functionality is highly dependent on the stability and immutability of an underlying system. Instead of RPA platforms, the same tasks can be executed more effectively by writing scripts (e.g., Python) and/or connecting with the underlying system using API calls. This eliminates the dependency on the assumption that the underlying system, its screens and workflow, are immutable (news flash: they’re not, they’re constantly changing).

A BOT (roBOT), also known as a Digital Worker, is a software program that performs automated, repetitive, pre-defined tasks. BOTS typically imitate a human user and can perform tasks at a faster rate and more accurately. For example, a BOT can be programmed to enter expense receipt data into a company’s finance system, or it can type information from a claims form directly into the claims platform. What are called “swivel-chair” tasks, where a human reads the data from a physical document on her left and types it into the keyboard on her right. Back and forth. And that data is extracted using IDP (as per above).

Another common component of IA is a Process Discovery platform. Tech-driven process discovery uses process mining technology to gain a data-based understanding of complex processes. This can be done by analyzing system event logs and/or desktop recordings of user activities. Process mining can help to identify potential tasks and use cases for automation and prioritize them based on their automation potential. However, Process Discovery is not required when a mortgage lender partners with an intelligent automation expert whose entire reasons for existence is to automate mortgage back-office processes. These experts, and the reason they are experts, is because they’ve already done the process discovery for the lenders, that’s why they have pre-built solutions that can be deployed with minimal configuration efforts. So if you’re a mortgage lender, don’t waste your time investing in process discovery, focus on finding the right intelligent automation partner.

How Should Intelligent Automation Technologies be Deployed

Now that the technology platforms that enable intelligent automation are understood, a fundamental question can be answered: how should these technologies be deployed in order for mortgage lenders to achieve the automation benefits quickly, efficiently and cost effectively?

Companies like Automation Anywhere, UiPath, Abbyy, AWS, Google, Microsoft, all have AI-enabled IDP platforms that can extract data from documents, and interpret the extracted data. Some also have RPA and Process Discovery platforms. They say they can deliver cost savings and improved efficiency out of the box.

They do, but in a limited manner. There is one final problem: that is the vertical domain-centric solution. The IDP platforms listed above work well when deployed as point solutions i.e., solving one single problem, for example, extracting data from a driver’s license or from a W2 form; but they are inefficient when it comes to interpreting the domain-specific requirements of the mortgage vertical and integrating into an existing mortgage ecosystem. Intelligent Automation is not just about building and deploying BOTS and extracting data with IDP, it’s about ensuring that the domain knowledge is embedded into the solution so that the platform can be deployed faster and can accelerate the ROI for the mortgage lender.

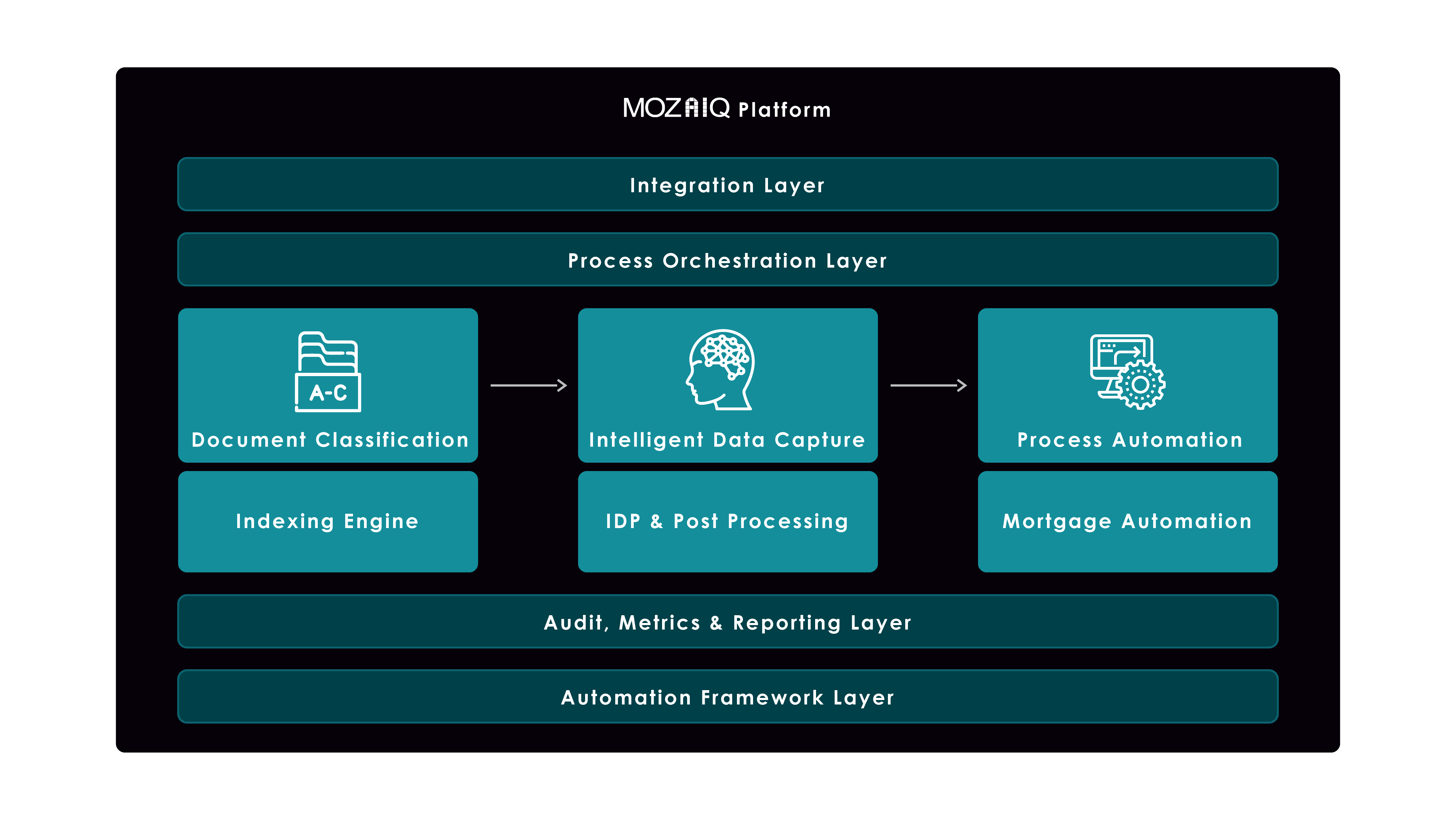

An effective Intelligent Automation solution requires that multiple components work seamlessly together—AI, IDP, and RPA. A BOT needs to be trained. A BOT needs to be managed. The documents need to be classified (indexed), and data needs to be extracted AND cleansed before the BOTs can go to work. Loan origination systems need to be integrated with. Audit trails are mandated. A complete, vertically focused solution contains the following components in one seamless offering:

Process Orchestration Layer: An automated process usually requires multiple BOTS to work in a coordinated fashion. They need to be managed by an intelligent “BOT manager” to facilitate communication, handoffs, error and exception handling. The BOT manager needs to be optimized for the specific set of processes it is overseeing.

Automation Framework Layer: The RPA and IDP products should be deployed to build scalable, reusable and manageable solutions for the target vertical. A solution should be able to choose which RPA and IDP platform is best suited for a specific function, because no size fits all. Each vendor, whether its AA or UiPath or Microsoft or AWS, does certain tasks better than others—it’s up to the solution architect to know when the Microsoft IDP solution should be used over the AA IDP solution. This knowledge should be embedded in the solution.

Intelligent Data Processing (IDP) and Classification: AI and ML Tools should have pre-built digital workers and processes to enable the foundational document classification processes, and the data extraction and post-processing for mortgage documents.

Audit, Metrics & Reporting Layer: No two processes are alike, and no two clients are the same, meaning that every automation deployment must be tested to ensure the right level of accuracy is achieved. An integrated solution should come with reporting on process metrics and the ability to seamlessly audit the digital workers (BOTS).

Integration Layer with Systems of Records: The integrated solution should work with the more common loan origination systems e.g., Encompass, Empower, Blue Sage.

Business Process Outsourcing: BPO resources, whether on-shore or off-shore, support the intelligent automation solution to perform exception handling tasks, validate that the machine is performing to its SLAs, and providing an escalation path to resolving complex issues. For example, no existing IDP solution extracts data with 100% accuracy, and expert human resources can be used ot validate the “last mile” e.g., the last 15% to achieve 100% system accuracy.

Benefits of Intelligent Automation

Intelligent automation, either as a standalone solution or in support of in-house or outsourced (BPO) resources, has enabled mortgage lenders to achieve significant benefits, benefits that increase competitiveness, deliver superior customer service to their upstream (e.g., brokers, consumers) and downstream (e.g., investors, servicers) constituents, and positions lenders to better manage through the peaks and valleys of fluctuating loan volumes.

The extended benefits that intelligent automation brings to mortgage lenders include:

Effortless Scale: Intelligent automation enables mortgage lenders to scale their operations (up or down) at the literal push of a button. As volumes increase, additional Virtual Machines (VMs) can be deployed on the cloud, as well as more BOTS, or digital workers, to support the growth. It sets the lender up to absorb the inevitable increases in loan volumes once the market rebounds, while maintaining a higher quality of loans, without having to hire expert resources in line with volume increases (or fire them when volume dries up). This phenomenon is called enabling an Accordion Workforce made up of Digital Workers, that expands and contracts based on loan volume. It mitigates the mistakes of the past—not investing in back-office technology and hiring at a breakneck pace only to have to reduce the workforce when volumes inevitably drop.

Increased Efficiencies: With intelligent automation and its ability to automate mundane and/or repetitive tasks, such as indexing a loan package containing over 300 document types in less than two minutes, extracting data from scanned documents, entering data into a system of record (e.g., LOS), or comparing data extracted from the documents and the data in the LOS via configurable business rules, underwriters can now process loans up to 70% faster thanks to automation that supports multiple audit and review functions as part of the underwriter’s audit and review requirements. And, with improved governance, compliance and with robust audit trails and traceability, automation allows managers to track efficiencies at a loan and underwriter level, continually optimizing loan flow through the system.

Lower Costs: Intelligent automation enables lenders to do more, faster, with less costs incurred. It’s that simple. Automation performs the repetitive tasks, so lenders can let their expert, and expensive, resources focus on the high-value tasks, like making accurate credit decisions. In some cases, with the right partner, lenders will only pay for the automation that they consume, on a per transaction (loan) basis, thus converting fixed costs into variable costs. A study by FreddieMac (“Cost to Originate Study: How Digital Offerings Impact Loan Production Costs”, November 2021) found that the top cost-effective lenders originate loans nearly 3x more efficiently than their counterparts, that technology investments are critical in order to stay competitive, that lenders who adopt digital offerings tend to operate at costs that are $2,200 less per loan, have production cycles that are five days shorter, and achieve margins that are one hundred basis points higher. How much is that worth to a lender?

Higher Accuracy (and Quality): As has been discussed, intelligent automation improves accuracy by reducing manual errors and automating repetitive tasks. The machines are trained using AI to perform tasks and to continually optimize them. Where there is a need for an expert resource such as an underwriter to review the loan, for example, when performing a post-close audit prior to delivering the loan to a GSE or investor, the machine can perform the rote tasks of document indexing, data extraction, and execute business rules to validate data in the LOS against that on the documents, so that the underwriter (or loan reviewer/auditor) only has to deal with the exceptions, thus freeing them up to process more loans in the same amount of time. And with the new, stringent loan audit requirements mandated by the GSEs, who wouldn’t want to satisfy the needs of the GSEs and investors without incurring further costs, while increasing their loan quality?

Greater Speed (Loan Throughput): The FreddieMac study says it all: lenders who adopt technology in a strategic manner have lower costs per loan, and can process 3x the volume in the same amount of time. Not only is this due to automating manual processes where straight through processing can be achieved (for example, in the Loan Setup process, for functions such as Third-Party Orders, Intent to Proceed, Lock Confirmation, Sending Initial Disclosures and Re-Disclosures), it’s also due to the fact that loans can be processed 24×7 by the machine, eliminating bottlenecks created by the limitations of a human processor and the eight-hour workday.

IA at scale embeds automation in the organization’s DNA. It transforms the way enterprises think about their operations and creates the opportunity to reimagine their business by seamlessly integrating technology, processes, and people to achieve tangible business outcomes beyond cost and operational improvements. Intelligent automation employs an organization-wide automation strategy and drives these initiatives at scale to ensure that the enterprise realizes the impact and benefits across all business units and functions.

To see Intelligent Mortgage Automation in action, read how The Loan Store achieved the benefits of intelligent automation and how it was able to effortlessly absorb the volume growth incurred with the acquisition of the Homepoint origination assets.

Don’t get left behind— Contact MOZAIQ now and see how intelligent automation can help you scale, enhance your competitiveness, reduce your cost per loan, and increase your bottom line.