How Intelligent Automation Can Help Lenders Scale

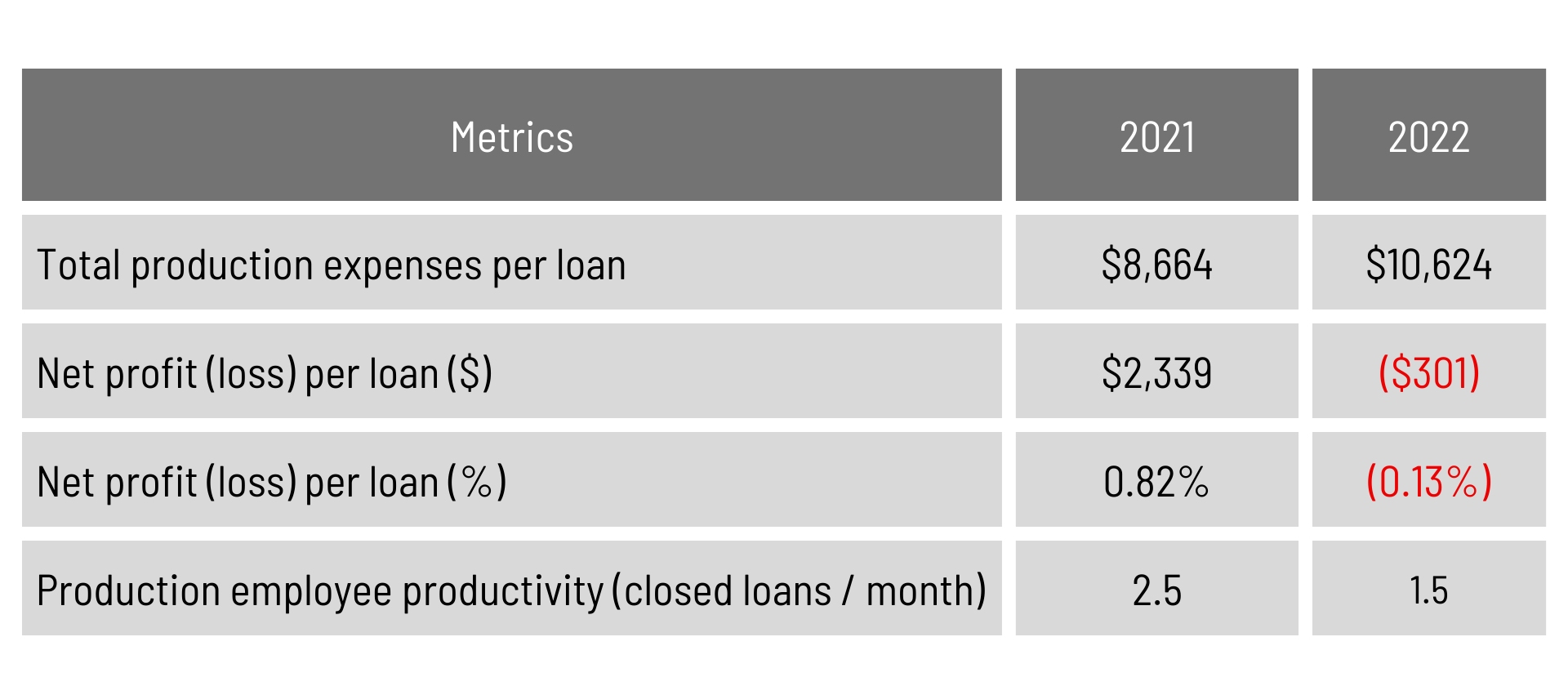

The Mortgage Bankers Association’s (MBA) Annual Mortgage Bankers Performance Report for 2022 was released at the beginning of April, and the data, although not a surprise, was disconcerting.

Interpreting the data

As loan volumes precipitated, lenders could not adjust their capacity fast enough—the number of production employees did not decline at the same pace as origination volume declines, causing production expenses per loan to increase and already tight profit margins to evaporate and turn negative. No lender can afford to make a single mistake in this environment.

And mistakes are more prevalent with lenders that have not invested in technology and automation, having to rely on employees for complex and simple tasks, from underwriting a loan to locking a rate, instead of creating a hybrid environment where technology and automation can alleviate the load of the more repetitive, mundane tasks.

Add on new GSE (Fannie and Freddie) requirements and a challenging scenario unfolds: all lenders must now audit 10% of files at the Pre-Fund stage, instead of the current 5% of files; and Post Close Quality Control reviews will be required to be complete within 90 days instead of the current 120 days. Lenders have already cut their teams to the bone. How will they comply?

The Loan Store

The Loan Store (TLS), a national wholesale lender and one of MOZAIQ’s clients, was created with a philosophy comprised of two simple drivers: (1) be the low-cost lender with (2) superior customer service. To support these two drivers, TLS would scale by leveraging outsourcing where it made sense and invest in technology and automation. They knew that because a mortgage loan is a commodity, if they stayed focused on these two drivers, they could sustain growth and profitability, and win.

Fast forward to today, and The Loan Store has automated a large portion of their backoffice:

- Loan Document Indexing: over 300 mortgage document types indexed out of the box

- Loan Setup: includes Lock Confirmation, Service Orders, and Intent to Proceed

- Loan Estimate Generation: includes automated interaction with brokers and lenders

- Disclosures: automatically generate and send Initial Disclosures & Redisclosures

- Pre-Underwriting and Final CD Audits: includes document indexing, data extraction and validation, and a user-friendly UI to enable audits

- Loan Delivery: generate required reports and closing forms, and send to Fannie, Freddie, Investor Connect and others

Enter Homepoint

And then in early April 2023 Homepoint, the third-largest wholesale lender by origination volume in 2022, announced that it was selling its origination channel assets to The Loan Store, which will allow TLS to scale its loan origination business into a leading national wholesale and correspondent mortgage lender. Homepoint is only bringing a skeleton operations crew over as part of the sale. No technology is coming over.

So how will TLS support a projected ten-fold increase in origination volume in the first three months post integration? How will they scale in the next 6, 12, 18 months? How will they comply with the new Fannie and Freddie requirements?

The answer is automation.

Scaling with Automation

Because TLS was built from day one to be nimble and to leverage technology to enable growth, the infrastructure to scale is already there. With automation, all TLS has to do, with MOZAIQ’s help, is deploy additional Virtual Machines (VMs) on the cloud, and deploy more BOTS, or digital workers, to support the growth.

In parallel, TLS is going to reduce its reliance on RPA BOTS and transition to automation via APIs, in order to reduce the inherent errors that an RPA-only implementation has, and to speed up the processing (in order to function, RPA BOTS rely on the underlying systems and screens to remain immutable, which is rare when using third-party systems like Encompass, Empower, Blue Sage or Fannie and Freddie).

No changes to processes, no changes to the pipeline, no changes to the loan flow. Just a simple provisioning of incremental automation resources and the additional volume is absorbed effortlessly and seamlessly.

The Outcomes

The business benefits gained by automating back-office mortgage fulfillment processes include:

- Higher loan quality and loan accuracy, helping to satisfy the new GSE audit requirements and eliminate potential penalties, both reputational and fiscal

- Faster loan throughput times (up to 3x), allowing the same number of processors to do more with less

- Reduced cost per loans, in some cases up to 60% depending on the process, the savings going straight to improving profitability

- 24×7 Loan processing at anytime of day, or night, further increasing loan throughput and enhancing customer service

- Scale up, or down by provisioning technology resources instead of human processors, literally at the touch of a keystroke

- Outcome-based transaction pricing, the lender only pays for what they use, shifting loan processing costs from fixed to variable, enhancing their bottom line

TLS has already experienced these benefits over the past two years as it has progressively added automated processes to its loan fulfillment pipeline, and now these benefits will continue to translate directly to higher loan profitability and superior customer service, which is exactly what The Loan Store’s objectives have been from day one.

Don’t get left behind—Contact us for a free automation diagnostic and see how automation can work for you and enhance your competitiveness, and your bottom line.