Solution Spotlight – Post-Close Audit and Loan Delivery

This extended post highlights one of MOZAIQ’s most powerful pre-built automated processes—Post-Close Audit and Loan Delivery—demonstrating the positive operational impact of intelligent mortgage automation.

Who is this Solution For?

The solution is used by wholesale lenders who originate mortgage loans and then sell the loans to a third party, a GSE, like Fannie or Freddie, or another third-party investor. The audit component of the automation solution—Checkpoint Audit—can be used in multiple parts of the loan fulfillment lifecycle. The Loan Delivery process is just one of many automated processes that uses the Checkpoint Audit platform.

The use case is simple: before the loan is transferred to an investor, the Post-Close team audits the loan for any corrections that are required. Once the loan passes the audit, the post-close auditor marks the loan as ready for Shipping, and the loan is transferred, or shipped, to the investor.

Why is there a need for this?

In today’s market, with declining origination and refi volumes, every loan that is originated and sold to an investor is precious to the lender. It’s gold. When times were good, margins were good, but now we’re seeing loan margins drop by over 60%, and in some cases, lenders are processing loans at cost just to get loans in the door. This is unsustainable.

Given the competitiveness of the market, another important factor comes into play—Loan Quality, which I talked about in a prior post.

Suffice it to say that no one in the mortgage ecosystem—brokers, loan officers, realtors, or borrowers—wants to work with a lender that closes a loan and then must bring the borrower back to the table to re-sign or even re-negotiate loan terms or requests additional documentation.

And, the faster the loan is sold to an investor, the faster the lender can replenish their line of credit and avoid incurring late fees, if it’s not delivered accurately and promptly.

How does it work?

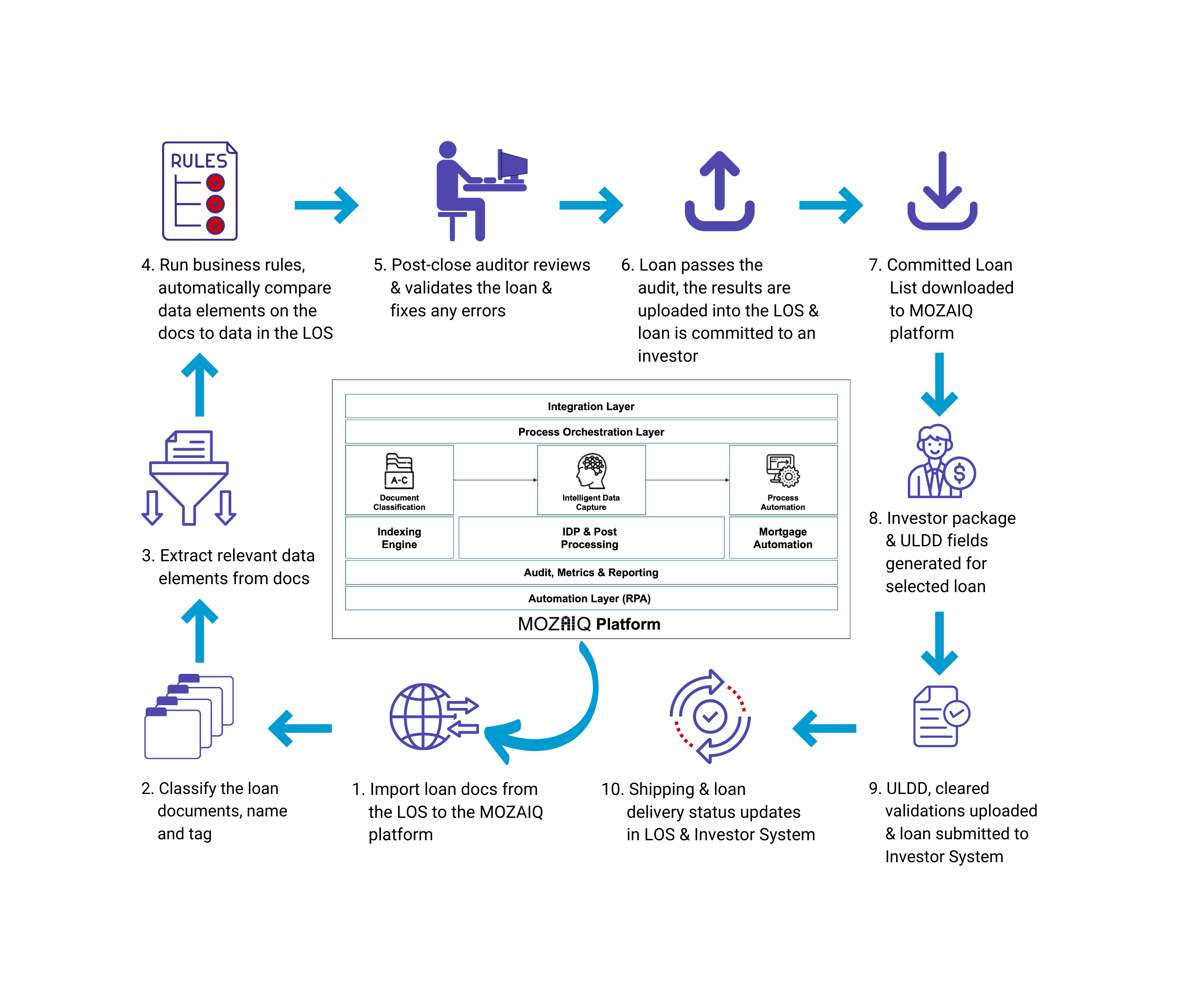

The post-closing team performs audits to ensure a loan is complete prior to being sent to an investor (this is an example for a wholesale lender):

- Import loan documents from the loan origination system (LOS) to the MOZAIQ platform

- Classify the loan document – index, name and tag

- Extract relevant data elements from the documents

- Run the business rules, and automatically compare data elements on the documents to data in the system of record (LOS)

- The Post-close auditor (human processor) reviews & validates the loan and fixes the errors where possible, for example:

- Missing and expired documents

- Missing data

- Mismatched data and documents

- Checks for erroneous calculations

- Once the loan passes the audit, the auditor approves the loan, the results are uploaded into the LOS and the loan is committed to an investor, ready to be delivered.

The largest benefit from this is that it keeps the process consistent and removes human errors, like (a) forgetting to check each and every data element across the system of record and (b) ensuring all important documents are present.

Because the automated audit leverages indexing, data extraction and a rules engine to ensure a consistent review, it provides the auditor with clearly identified and actionable information they can focus on resolving, as automating the repetitive steps and letting the high value team member work on resolving issues adds quantifiable value.

Once the loan is committed to an investor, an ops resource kicks off the Loan Delivery process in the Loan Origination System (LOS). The MOZAIQ automation platform monitors a queue in the LOS and when one or more loans are committed, imports the loan list and initiates the process – every step is then automated:

- Committed Loan List is downloaded to the MOZAIQ platform

- The investor package and ULDD (standard data set) fields are generated for the selected loan

- The ULDD and cleared validations are uploaded to the LOS and the loan is submitted (transferred) to the Investor System

- Loan delivery status is updated in both the LOS and Investor Systems

What are the benefits?

Auditing plus Intelligent Automation ensures that loan reviews are consistently done the same way every time. The combination:

- Reduces human errors

- Guarantees high loan quality

- Enables higher loan throughput (we’ve seen by up to 4x)

- Reduces manual processing of a loan package by 75% (for this process)

- Enables 24/7 reviews

- Decreases cost per loan by up to 60%

Make no mistake: The automation of the Post-Close Audit and Loan Delivery processes does not remove humans from the decision making. On the contrary, it helps them be more efficient by finding and highlighting potential issues that the underwriter or operations team can then make a decision on.

Finally, and most importantly, it sets the lender up to absorb increases in loan volumes (once the market rebounds) while maintaining a higher quality of loans, without having to hire expert resources in line with volume increases.

We call this enabling an Accordion Workforce made up of Digital Workers, that expands and contracts based on loan volume. It mitigates the mistakes of the past—not investing in back-office technology and hiring at a breakneck pace only to have to reduce your workforce when volumes inevitably drop.

If you want to be a mortgage winner in 2023, invest in Intelligent Automation now.

MOZAIQ helps you make faster, lower cost, more accurate lending decisions. Contact us today and see a demo of our platform in action.